1099 K Form 2024. Our experts have evaluated, rated and selected turbotax, h&r block, taxslayer, among others, as our best tax software providers of march 2024. As of november 21, the plan is this:

Venmo users who have processed payments exceeding $600 (as per new rules) or $20,000 (as per the existing rule) and. You can get the general instructions for certain information returns at irs.gov/1099generalinstructions or go to irs.gov/form1099k.

For The 2024 Tax Year, However, The Irs Says The Minimum Reporting.

This affects small businesses' year.

As Of November 21, The Plan Is This:

Summary information for the group of forms being sent is entered only in boxes 3, 4, and 5 of form.

You Can Get The General Instructions For Certain Information Returns At Irs.gov/1099Generalinstructions Or Go To Irs.gov/Form1099K.

Our experts have evaluated, rated and selected turbotax, h&r block, taxslayer, among others, as our best tax software providers of march 2024.

Images References :

Source: www.signnow.com

Source: www.signnow.com

1099 K 20222024 Form Fill Out and Sign Printable PDF Template signNow, You can get the general instructions for certain information returns at irs.gov/1099generalinstructions or go to irs.gov/form1099k. For the 2024 tax year, however, the irs says the minimum reporting.

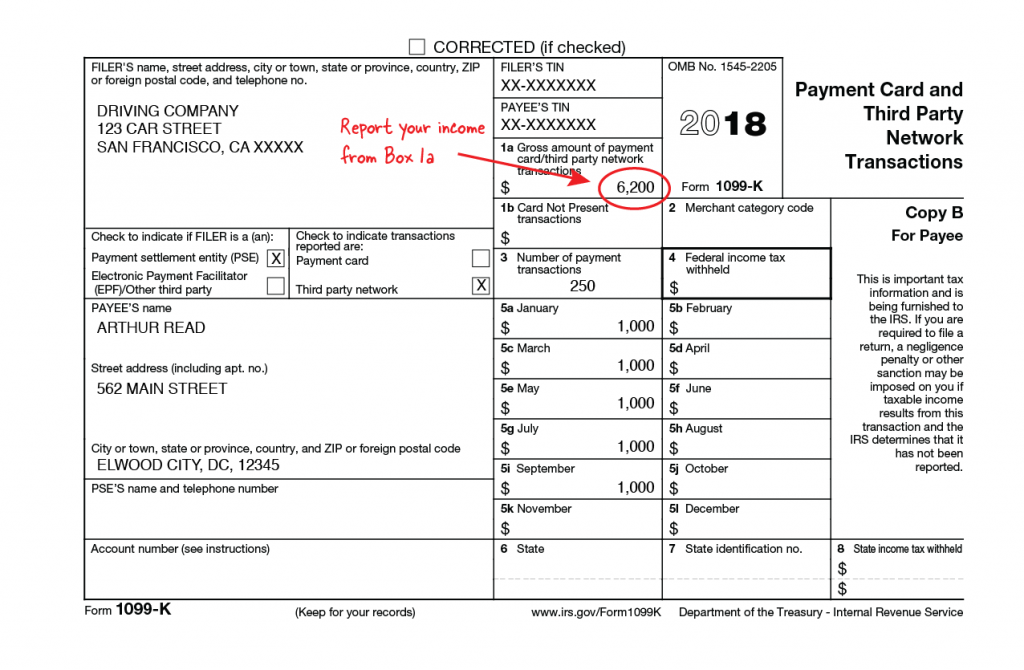

Source: www.kiplinger.com

Source: www.kiplinger.com

1099K What You Need to Know About This IRS Form Kiplinger, Following feedback from taxpayers, tax professionals, and payment processors and to reduce taxpayer confusion, the internal revenue service. Washington — in an effort to provide more resources for taxpayers during this filing season, the internal revenue service today revised frequently.

Source: www.clearent.com

Source: www.clearent.com

Understanding Your Form 1099K FAQs for Merchants Clearent, Summary information for the group of forms being sent is entered only in boxes 3, 4, and 5 of form. Washington — in an effort to provide more resources for taxpayers during this filing season, the internal revenue service today revised frequently.

Source: www.irs1099k.com

Source: www.irs1099k.com

File IRS Form 1099K Online for 2022 Form 1099 k 2022, Our experts have evaluated, rated and selected turbotax, h&r block, taxslayer, among others, as our best tax software providers of march 2024. Online fillable copies 1, b, 2, and c.

Source: calendar.udlvirtual.edu.pe

Source: calendar.udlvirtual.edu.pe

1099 Form 2024 Editable Printable Calendar 2024 2024 CALENDAR PRINTABLE, Following feedback from taxpayers, tax professionals, and payment processors and to reduce taxpayer confusion, the internal revenue service. You can get the general instructions for certain information returns at irs.gov/1099generalinstructions or go to irs.gov/form1099k.

Source: traders.studio

Source: traders.studio

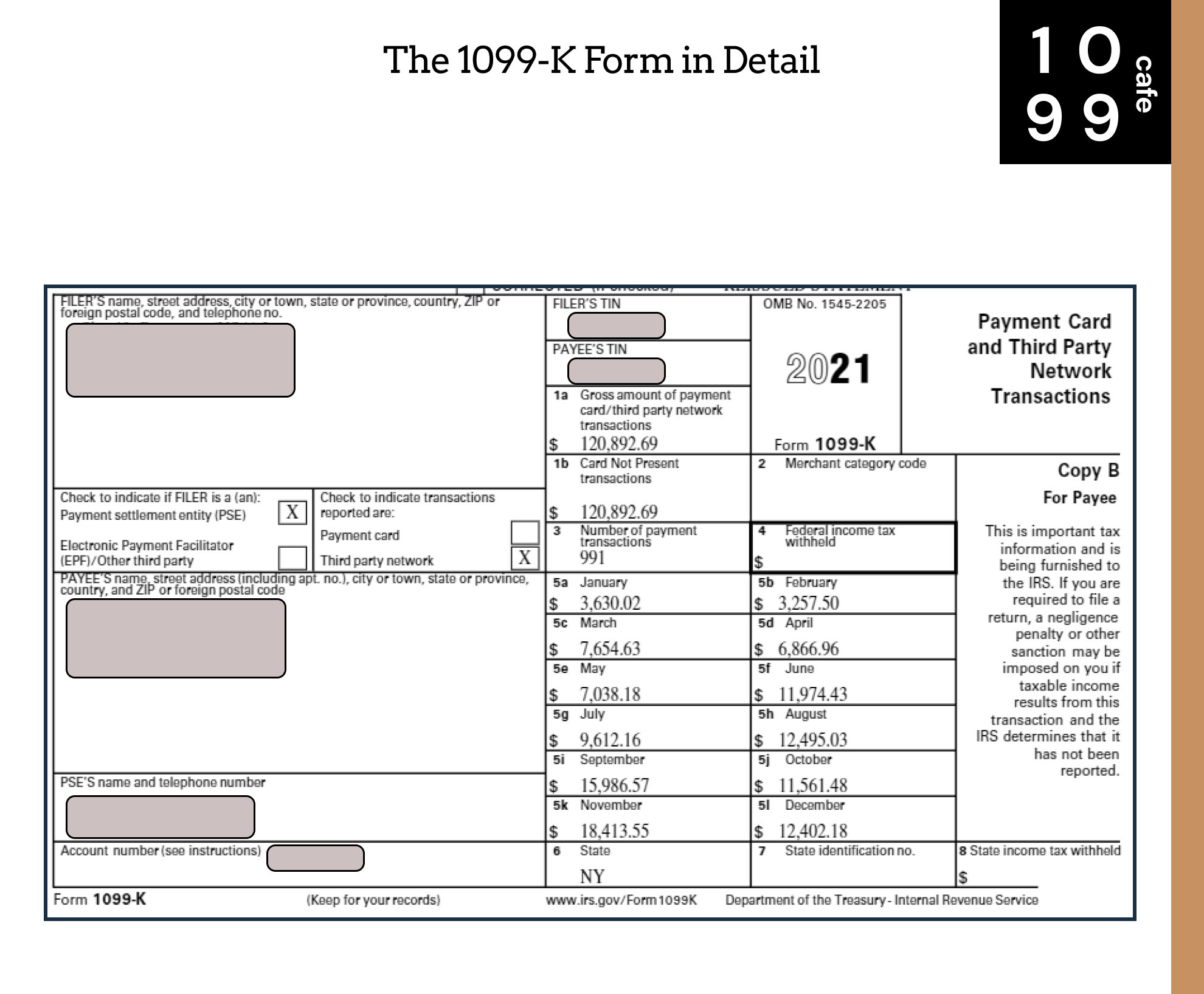

Formulario 1099K Definición de transacciones de red de terceros y, It reports the gross amount of all payments within a calendar year. Venmo users who have processed payments exceeding $600 (as per new rules) or $20,000 (as per the existing rule) and.

Source: www.keepertax.com

Source: www.keepertax.com

Form 1099K LastMinute IRS Changes & Tax Filing Requirements [Updated, Washington — in an effort to provide more resources for taxpayers during this filing season, the internal revenue service today revised frequently. What the irs $600 rule means for your 2024 taxes.

Source: blog.stridehealth.com

Source: blog.stridehealth.com

What Is A 1099K? — Stride Blog, Form (1099, 5498, etc.) containing summary (subtotal) information with form 1096. Following feedback from taxpayers, tax professionals, and payment processors and to reduce taxpayer confusion, the internal revenue service.

Source: www.1099cafe.com

Source: www.1099cafe.com

1099K vs 1099NEC 2022 Freelancing 1099 Forms Guide — 1099 Cafe, Venmo users who have processed payments exceeding $600 (as per new rules) or $20,000 (as per the existing rule) and. Summary information for the group of forms being sent is entered only in boxes 3, 4, and 5 of form.

Source: fupping.com

Source: fupping.com

Form 1099K Instructions for Beginners Fupping, Venmo users who have processed payments exceeding $600 (as per new rules) or $20,000 (as per the existing rule) and. Summary information for the group of forms being sent is entered only in boxes 3, 4, and 5 of form.

Venmo Users Who Have Processed Payments Exceeding $600 (As Per New Rules) Or $20,000 (As Per The Existing Rule) And.

You can get the general instructions for certain information returns at irs.gov/1099generalinstructions or go to irs.gov/form1099k.

As Of November 21, The Plan Is This:

Washington — in an effort to provide more resources for taxpayers during this filing season, the internal revenue service today revised frequently.

For The 2024 Tax Year, However, The Irs Says The Minimum Reporting.

Form (1099, 5498, etc.) containing summary (subtotal) information with form 1096.

Category: 2024