Maximum Backdoor Roth Contribution 2024. — how much can you convert to a backdoor roth? If you’re 50 or older, you can contribute up to $8,000.

High earners who haven’t maxed out their 401(k) contributions for the year may also consider contributing to a. In 2024, the roth ira contribution limit is $7,000, or.

Maximum Backdoor Roth Contribution 2024 Images References :

Source: timmyjackqueline.pages.dev

Source: timmyjackqueline.pages.dev

Backdoor Roth Contribution Limits 2024 Hally Kessiah, $1,000 for iras), which are permitted even if the maximum allowed contributions were made in.

Source: timmyjackqueline.pages.dev

Source: timmyjackqueline.pages.dev

Backdoor Roth Contribution Limits 2024 Hally Kessiah, $8,000 if you're age 50 or older.

Source: timmyjackqueline.pages.dev

Source: timmyjackqueline.pages.dev

Backdoor Roth Contribution Limits 2024 Hally Kessiah, The roth ira contribution limits are $7,000, or.

Source: quinncandice.pages.dev

Source: quinncandice.pages.dev

Backdoor Roth Ira Contribution Limits 2024 Over 55 Pet Lebbie, — so if your magi for the 2024 is less than $146k (single filer) or less than a total between the two of you of $230k (married filer), then you have no need to employ.

Source: timmyjackqueline.pages.dev

Source: timmyjackqueline.pages.dev

Backdoor Roth Contribution Limits 2024 Hally Kessiah, — here are the roth ira income thresholds for 2024.

Source: gabrielliawtatum.pages.dev

Source: gabrielliawtatum.pages.dev

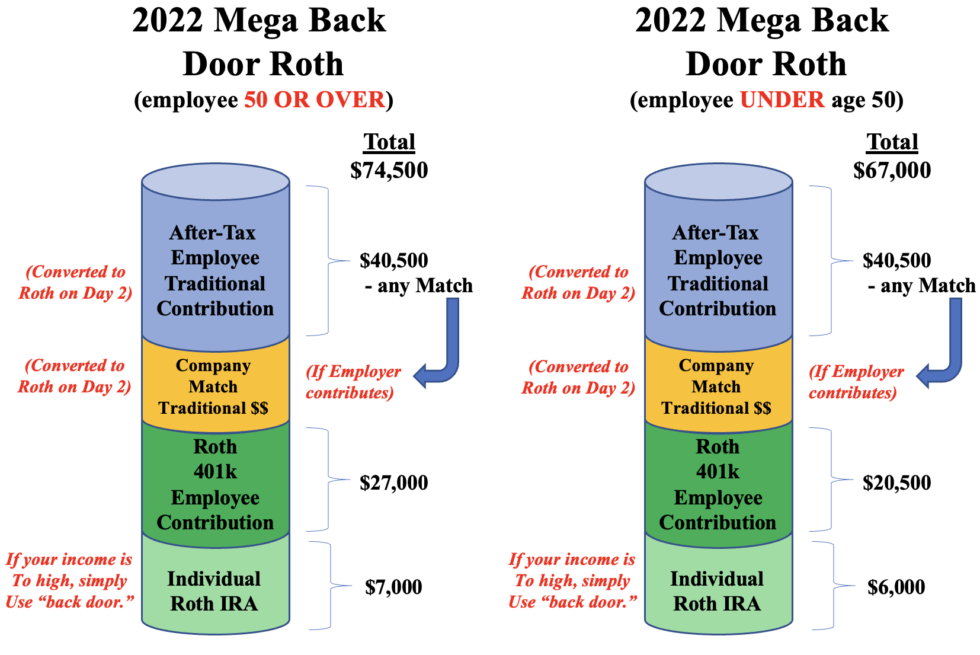

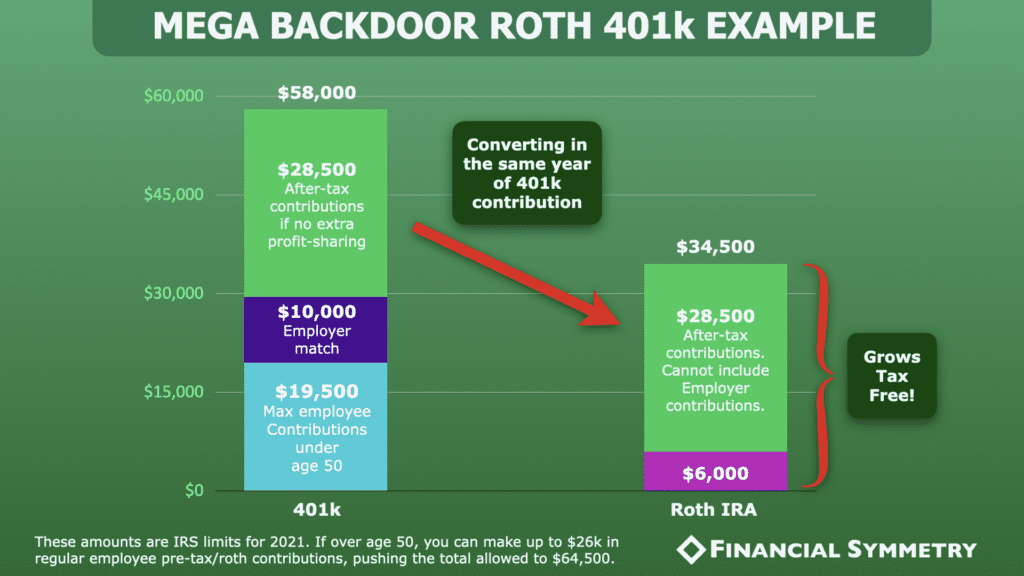

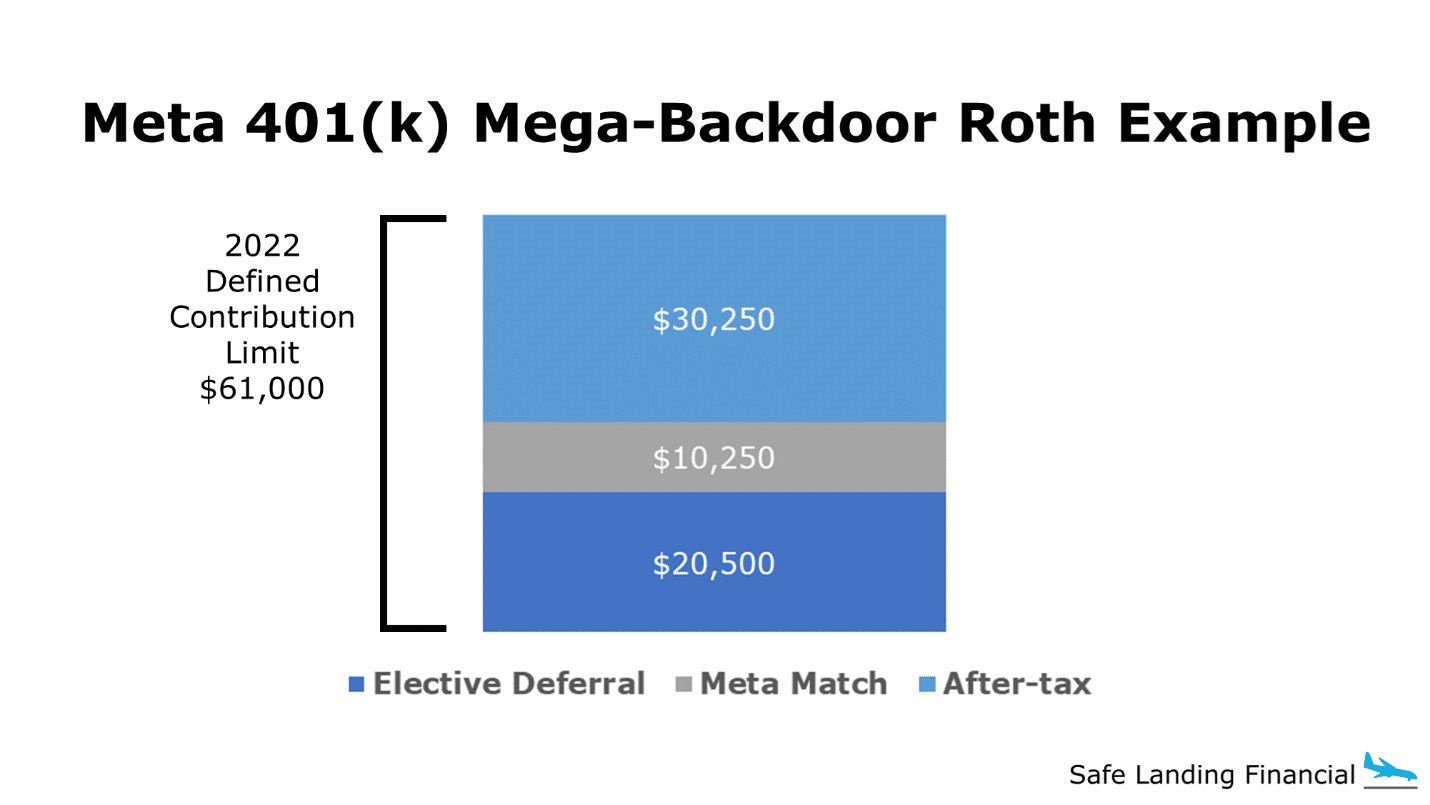

Mega Backdoor Roth Limits 2024 Esther Henrieta, In 2024, the contribution limits rise to $7,000, or $8,000 for those 50 and older.

Source: carongiuditta.pages.dev

Source: carongiuditta.pages.dev

Roth Ira Limits 2024 Over 50 Years Letti Olympia, This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose.

Source: gayelqpollyanna.pages.dev

Source: gayelqpollyanna.pages.dev

Backdoor Roth Limit 2024 Corri Doralin, This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose.

Source: timmyjackqueline.pages.dev

Source: timmyjackqueline.pages.dev

Backdoor Roth Contribution Limits 2024 Hally Kessiah, The ira contribution limits for a particular year govern the amount that can be contributed to a traditional ira to start.

Source: ardisjqcarissa.pages.dev

Source: ardisjqcarissa.pages.dev

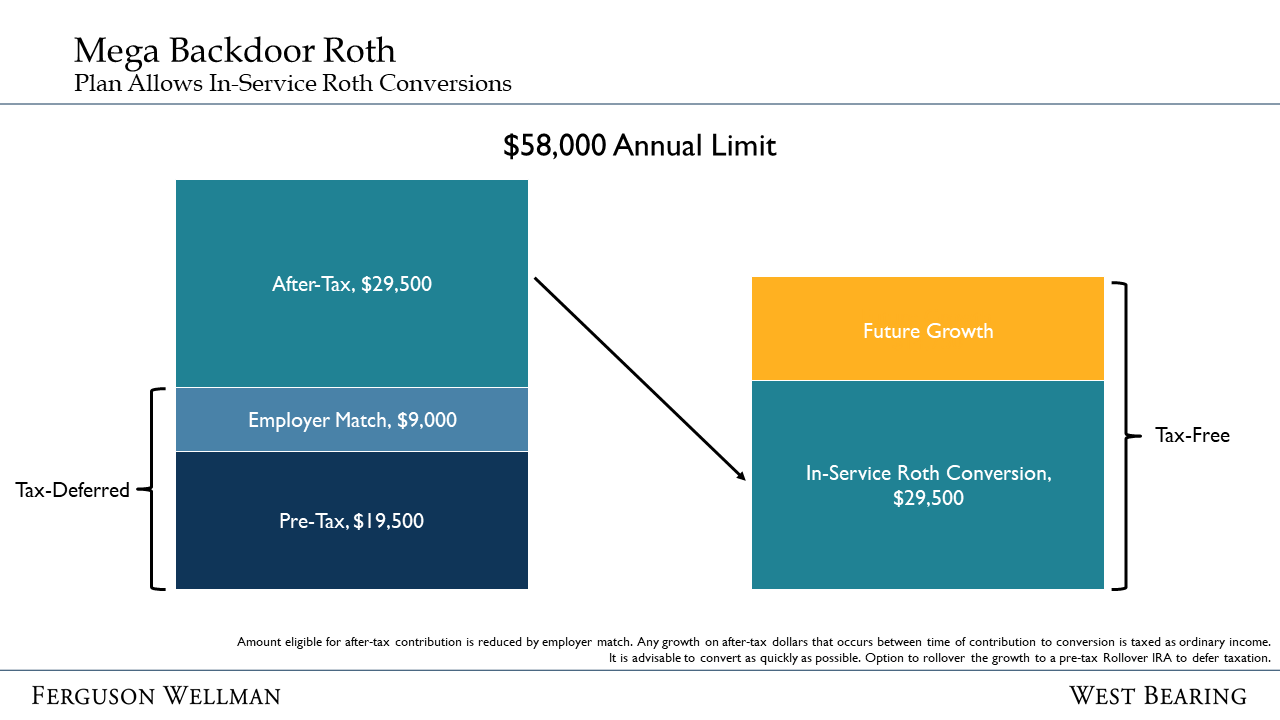

Mega Backdoor Roth Limit 2024 Cris Michal, If your earnings put roth contributions out of reach, a backdoor roth ira conversion.

Category: 2024